Understanding Personal Loans for Bad Credit and High Debt

페이지 정보

본문

personal loans for bad credit under 550 loans can be a lifeline for individuals dealing with financial difficulties, particularly these with bad credit or excessive debt. This report delves into the intricacies of personal loans for people in these difficult conditions, exploring the varieties of loans out there, their phrases, and best practices for securing funding.

What Are Personal Loans?

Personal loans are unsecured loans that people can use for varied functions, equivalent to consolidating debt, protecting medical bills, or financing home enhancements. Unlike secured loans, which require collateral, personal loans are based on the borrower's creditworthiness and skill to repay. This makes them particularly interesting for many who may not have property to pledge.

Unhealthy Credit and Its Influence on Loan Eligibility

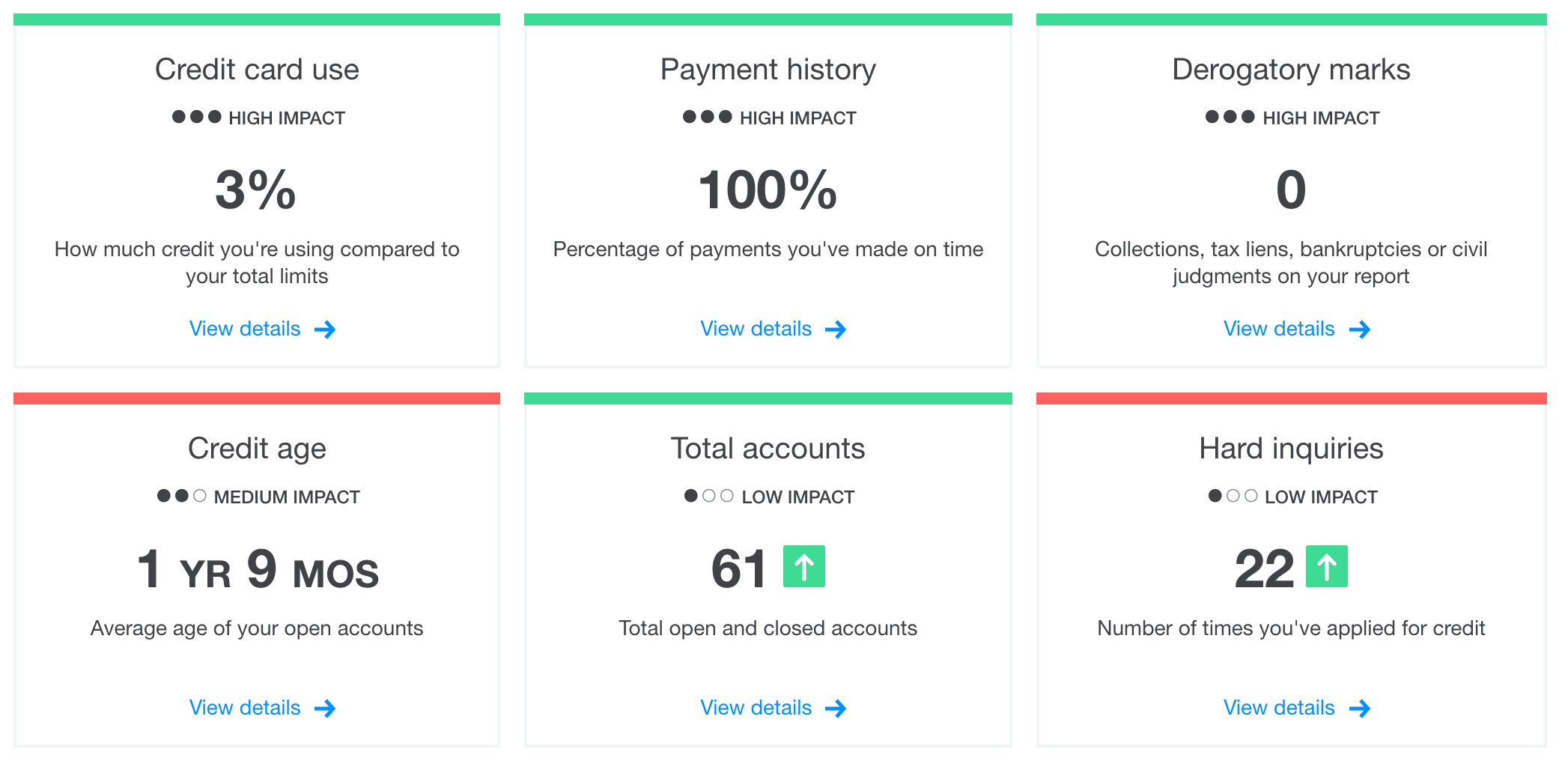

Bad credit score sometimes refers to a credit rating below 580 on the FICO scale. Components contributing to unhealthy credit include missed payments, excessive credit score utilization, and bankruptcy. Individuals with dangerous credit score often face challenges when applying for loans, as lenders understand them as excessive-risk borrowers. This will lead to larger interest rates, much less favorable terms, or outright denial of the loan application.

Sorts of Personal Loans for Bad Credit

- Peer-to-Peer Lending: Platforms like LendingClub and Prosper join borrowers with individual buyers willing to fund loans. These platforms often have extra lenient credit score necessities compared to conventional banks, making them a viable possibility for those with dangerous credit score.

- Credit Union Loans: Credit score unions are nonprofit organizations that often provide loans to their members at lower interest charges. They could also be more prepared to work with people with poor credit histories, particularly if the borrower has a history with the credit union.

- Secured Personal Loans: Borrowers with bad credit may consider secured loans, which require collateral similar to a vehicle or savings account. Whereas this reduces the lender’s danger, it additionally implies that the borrower dangers losing the collateral if they default.

- Specialised Lenders: Some lenders specialize in offering loans to people with bad credit score. In case you beloved this article as well as you would like to be given guidance about personal loans for bad credit and high debt (elobr.com) kindly visit our web site. These lenders usually cost higher curiosity rates and may have stricter repayment phrases, however they can be a source of funding for those who have exhausted different options.

Curiosity Charges and Terms

Interest charges for personal loans can vary significantly based mostly on the lender, the borrower’s credit score rating, and the loan quantity. For individuals with bad credit score, curiosity charges can vary from 10% to 36% or extra. It’s crucial for borrowers to understand the full value of the loan, including any charges related to origination or late payments.

Loan terms also can differ, sometimes ranging from one to seven years. Shorter loan terms often come with higher month-to-month funds but end in much less interest paid over the life of the loan. Conversely, longer phrases cut back monthly payments but enhance the overall interest cost.

Debt Consolidation as a method

For individuals with excessive debt, consolidating a number of debts right into a single personal loan generally is a strategic strategy. This will simplify finances, reduce the number of month-to-month payments, and doubtlessly decrease the overall interest price. Nonetheless, borrowers should ensure that the new loan terms are favorable and that they'll handle the month-to-month funds.

Improving Your Possibilities of Approval

- Test Your Credit score Report: Before applying for a loan, borrowers should evaluate their credit score studies for errors and take steps to appropriate any inaccuracies. Understanding one’s credit score profile can assist in addressing points that will hinder approval.

- Consider a Co-signer: Having a co-signer with good credit can enhance the probabilities of loan approval. The co-signer agrees to take accountability for the loan if the first borrower defaults, which reduces the lender's threat.

- Reveal Revenue Stability: Lenders are more likely to approve loans for individuals who can demonstrate a steady income. Offering documentation of employment and income can strengthen the application.

- Store Round: Totally different lenders have varying criteria and interest rates. Borrowers ought to examine affords from multiple lenders to search out the very best terms obtainable.

- Prepare for Larger Curiosity Rates: Borrowers must be prepared for greater interest charges related to unhealthy credit loans. Comparing the entire cost of loans, including charges, can assist in making an knowledgeable decision.

Risks to contemplate

Whereas instant personal loan bad credit loans can provide rapid monetary relief, additionally they come with dangers. Excessive-interest rates can result in a cycle of debt if borrowers are unable to make timely payments. Moreover, missing funds can additional harm credit score scores, making future borrowing tougher.

Options to Personal Loans

For people hesitant to take on personal loans due to excessive interest charges or potential debt cycles, several options exist:

- Credit Counseling: Searching for assist from a credit score counseling service can provide methods for managing debt and improving credit scores with out taking on new loans.

- Debt Management Plans: Credit score counseling agencies can assist arrange debt management plans that negotiate lower curiosity charges with creditors, permitting individuals to pay off debts more successfully.

- Steadiness Transfer Credit Cards: For high-curiosity bank card debt, steadiness switch cards can provide lower introductory rates, providing a short lived reprieve from excessive curiosity.

- Private Savings: Utilizing personal financial savings or emergency funds can assist avoid the need for loans altogether. Building an emergency fund can stop future reliance on credit.

Conclusion

Personal loans for people with unhealthy credit and excessive debt can provide essential monetary support, but they require careful consideration and planning. Understanding the varieties of loans accessible, their terms, and the potential dangers is essential for making informed monetary decisions. By taking proactive steps to improve credit scores and manage funds, borrowers can enhance their chances of securing favorable loan phrases and reaching lengthy-time period monetary stability.

- 이전글Top Personal Loan Companies for Bad Credit: Your Information To Monetary Relief 25.10.26

- 다음글Betify casino avis jeux bonus et retraits fiables 25.10.26

댓글목록

등록된 댓글이 없습니다.